Bolån i Spanien

Bolånemäklare

Det är vi

Hypoteksmäklare i Spanien

De ledande finansieringsexperterna

OM OSS

I Mortgage in Spain.es är vårt uppdrag att hjälpa människor att köpa ett hus i Spanien genom ansvarsfulla bolån anpassade efter deras behov.

Vi har tillfredsställande avtal med de bästa bankerna i Spanien och vi kan erbjuda dig en bolånerådgivning med 0% mäklararvode

Vi studerar ditt ärende, diskuterar med några banker och erbjuder dig de bästa förutsättningarna utifrån dina specifika behov och helhetsbedömningen av din bolånefil. Vi kan få ett bolån med fast, rörlig eller blandad ränta med de bästa villkoren på den spanska bolånemarknaden.

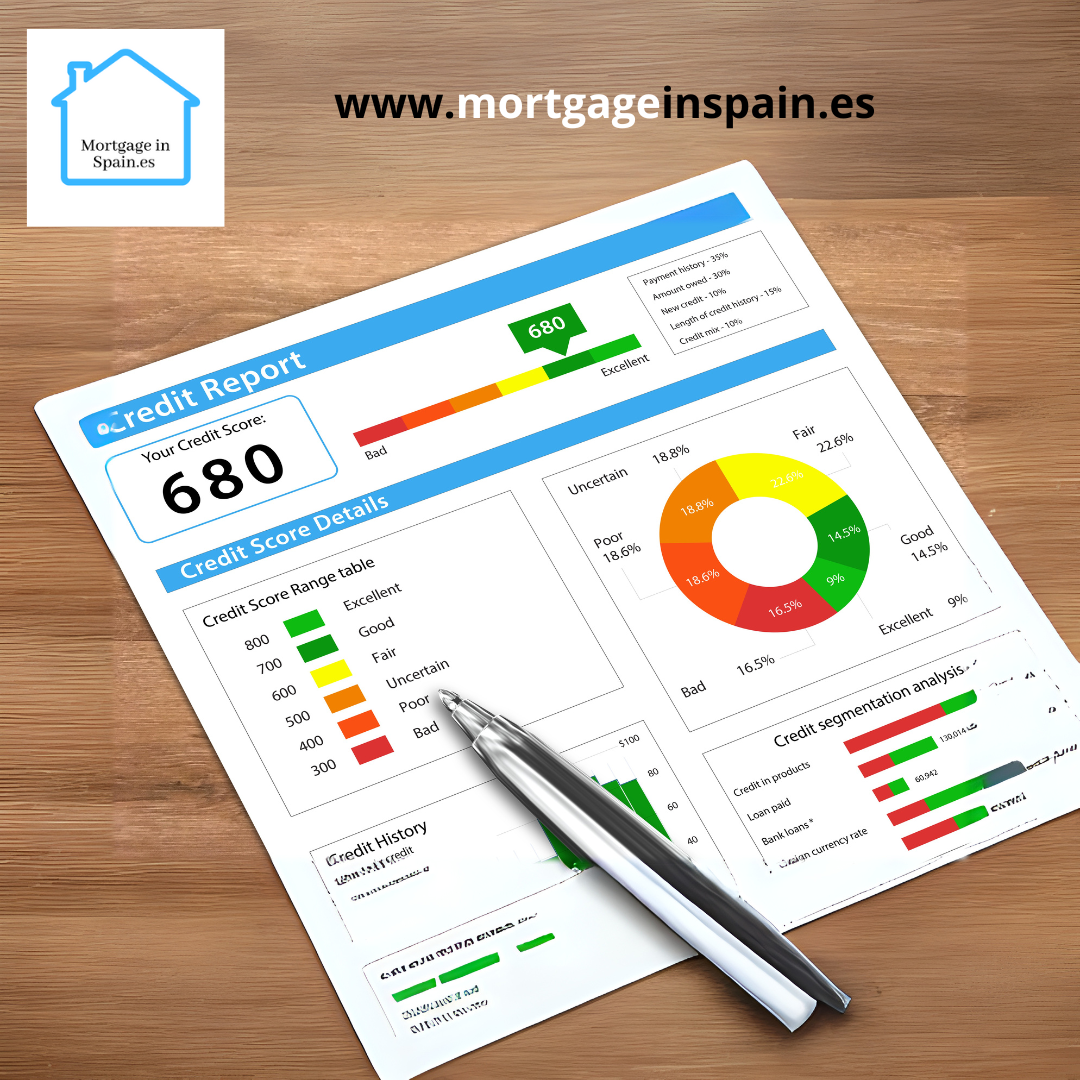

Bolåneansökan har ingen inverkan på din kreditupplysning förrän du undertecknar det accepterade bolåneerbjudandet hos notarie.

Våra mer än 15 års erfarenhet av den spanska bankmarknaden är en garanti för framgång.. Vi guidar dig enkelt genom den komplexa processen för bolånefinansiering i Spanien och förklarar dig hur mycket du kan låna från en spansk bank, hur mycket detta går på att kosta dig, kontantinsatsen du behövde och exakt vilka dokument du behöver lämna in. Hos oss är det enkelt att få ett bolån i Spanien.

Du får den bästa servicen från ett flerspråkigt team av bolånerådgivare som är helt certifierade enligt den spanska hypotekslagen (LCCI 5/2019). Vi bläddrar igenom och analyserar alla relaterade kostnader för ditt bostadslån i Spanien för att kunna erbjuda dig en kortfattad och professionell rådgivning: bankarrangemangsavgifter, provisioner för förtida återbetalning, skatter, värderingar och mer.

Det bästa sättet att få ditt lån i Spanien

Spara tid och pengar

Vi hanterar hela bolåneprocessen åt dig, vilket eliminerar behovet av att besöka flera banker för att få den bästa affären. Vi samarbetar med några av de bästa bankerna i Spanien, specialiserade på bolån för utländska medborgare, för att hitta det bästa erbjudandet skräddarsytt för dina specifika omständigheter.

Professionellt stöd

Mortgage in Spain drivs av certifierade bankexperter med erfarenhet från spanska banker. Vi är specialiserade på utländska bolån.

0% mäklararvode

Du betalar ingenting för våra tjänster. Vår mer än 15 års erfarenhet gör våra bankavtal framgångsrika.

Som en bolånemäklare verksam i Spanien förstår vi att det kan vara en skrämmande och komplex process att köpa en fastighet i ett främmande land. Spanien är ett populärt resmål för icke-invånare som vill investera i fastigheter, oavsett om det är för personligt bruk eller som en hyresinkomstinvestering. Som sådan är vi dedikerade till att förse icke-invånare med all nödvändig information för att hjälpa till att fatta välgrundade beslut om deras bolånealternativ i Spanien.

För det första är det viktigt att förstå att icke-invånare kan få bolån i Spanien, precis som invånare kan. Processen och kraven kan dock skilja sig något. Mängden bolån som är tillgänglig för utlänningar är vanligtvis lägre än den som är tillgänglig för invånare, och räntorna kan också vara högre. Detta beror på att långivare uppfattar utländska låntagare som låntagare med högre risk, eftersom de inte har en permanent närvaro i Spanien.

Processen för att ansöka om bolån för utländska medborgare är enkel. Det finns dock vissa krav som måste uppfyllas. Icke-bosatta kommer att behöva tillhandahålla bevis på inkomst, såsom lönebesked eller kontoutdrag, och kan behöva tillhandahålla ytterligare dokumentation såsom ett skatteregistreringsnummer. Långivare kommer också att kräva bevis på anställning och inkomstkälla.

När det kommer till de typer av bolån som är tillgängliga för icke-bosatta i Spanien, finns det flera alternativ. Bolån med fast ränta är populära, eftersom de ger säkerhet och stabilitet i månatliga betalningar. Bolån med rörlig ränta finns också, men de kan vara mer volatila eftersom de är kopplade till Euribor-räntan.

Slutligen är det viktigt att arbeta med en bolånemäklare som är bekant med den spanska bolånemarknaden och kan guida dig genom processen. På vårt mäklarhus har vi erfarna proffs som kan ge personlig rådgivning och hjälpa dig att hitta det bästa bolånet för dina behov.

Sammanfattningsvis kan icke-invånare få bolån i Spanien, men processen och kraven kan skilja sig något från dem för invånare. Det är viktigt att arbeta med en mäklare som kan guida dig genom processen och hjälpa dig att hitta det bästa bolånet för dina behov.

Att få ett bolån i Spanien

Bolån i Spanien. Allmän information

Bolån i Spanien

Njut av ditt nya hem i Spanien